Deputy Prime Minister and Finance Minister, Bishnu Prasad Paudel, has acknowledged the significant challenges faced by developing and least developed countries in managing resources for development, particularly due to their weakened capacity to mobilize internal revenues.

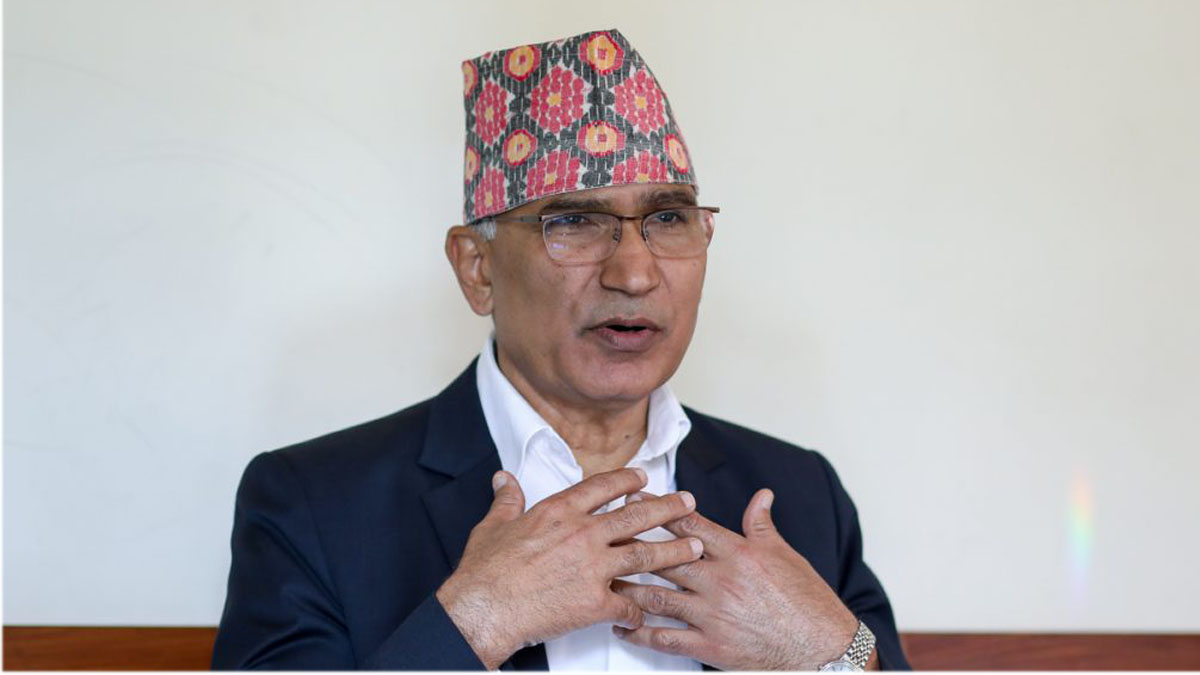

Speaking at the ‘Finance for Development Dialogue’ organized by the United Nations in partnership with the Ministry of Finance and the Federation of Nepalese Chambers of Commerce and Industry (FNCCI) in Kathmandu today, Minister Paudel noted that Nepal is grappling with low revenue collection and growing public debt obligations. He warned that the government’s investment in development activities is likely to shrink as a significant portion of the revenue is allocated to debt repayment, which threatens to delay the country’s progress towards meeting the Sustainable Development Goals (SDGs).

“The compulsion of investing a major portion of the revenue in paying the public debt has increased the risk of pushing far the aspiration of meeting the sustainable development goals,” Finance Minister Paudel remarked.

Minister Paudel emphasized the need for innovative and alternative methods of financing development, given the high trade deficit, slow economic growth, and declining development assistance. He also pointed out that developing and least developed countries, including Nepal, are disproportionately affected by climate change, despite contributing minimally to carbon emissions. This has forced these nations to allocate substantial budgets for climate change adaptation, further straining their financial resources.

“Nepal is marred by the direct impacts of climate change. Though we have almost no contribution to carbon emissions, we suffer its consequences disproportionately, forcing us to allocate a significant budget for climate change adaptation. So, Nepal wants to secure new resources and instruments for development finance,” he stated.

Minister Paudel also underscored the importance of preparing a comprehensive development fiscal plan that maximizes the utilization of all potential resources, including internal resources, private capital, and development assistance. He noted that while Nepal’s revenue-to-GDP ratio is relatively strong, its sustainability needs to be ensured. He also highlighted challenges related to public debt, trade deficit, low economic growth, and long-standing structural issues.

The Finance Minister called for increased collaboration between the government and the private sector, emphasizing the latter’s role as a key partner in the country’s economic development. He noted that the 16th periodic plan prioritizes private sector involvement and that the government is committed to creating an enabling environment for private investment by preparing a development finance plan that can attract private capital and focus on result-oriented projects.

He also shared the government’s commitment to legal reforms and policy-level clarity to attract both foreign and internal investment, noting that internal capital and technology are insufficient for Nepal’s development needs. “The government is committed to bringing in foreign capital and technology as well as to formulate all policy-level and legal infrastructures,” he said.

Minister Paudel mentioned that Nepal is aiming to graduate from a least developed country (LDC) to a developing country by 2026 and that a transitional strategy has been developed for this purpose. As part of this strategy, the country plans to conduct a ‘Sovereign Credit Rating’ to attract further investment.

FNCCI President Chandra Prasad Dhakal, also speaking at the event, highlighted the low volume of foreign direct investment (FDI) in Nepal, which currently stands at only 0.2% of the GDP. He expressed concern over the increasing reliance on loans, noting that public debt has doubled in the last nine years, posing a significant risk to the country’s economic stability, particularly as it transitions to a developing nation.

“The growing dependency on loan will add to the challenges at a time when the country is in the process of graduating to developing country from least developed one,” Dhakal opined.

Comments