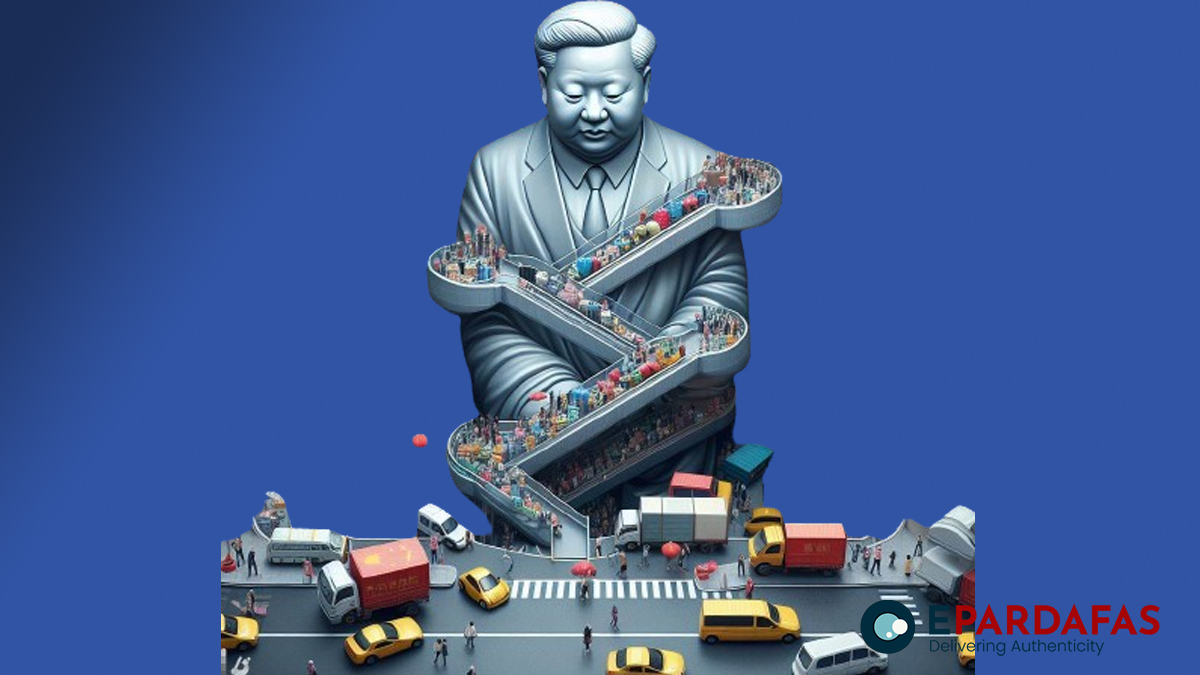

Deflationary Shift in China’s Retail Landscape Threatens Economic Stability

In a notable shift, Chinese retailers are adopting a strategy of offering lower-priced goods and services in a bid to attract cost-conscious consumers. However, this approach risks deepening deflationary trends within the world’s second-largest economy, potentially impacting wage growth, job creation, and hampering China’s post-COVID recovery.

The proliferation of price cuts, the emergence of bargain stores, and the introduction of scaled-down product versions may set off a vicious cycle, leading to reduced profit margins. This, in turn, could limit wage and job growth, further dampening consumer spending and complicating China’s economic rebound.

Parallels with Japan’s “lost decades” of stagnation are increasingly being drawn, as deflation concerns loom over China’s retail landscape. Falling income growth has become a norm, contributing to decreased consumption in various industries. Wang Dan, an economist at Hang Seng Bank in Shanghai, notes, “It is definitely a price decrease or low inflation environment now. Though it is hard to forecast how long the situation will last, but for sure it is bad for the economy.”

Several examples highlight this shift in strategy among Chinese retailers. Haidilao, China’s largest hotpot restaurant chain, introduced Hailao Huoguo, a lower-priced brand offering beef dishes for as low as 28 yuan ($3.92), down from 70 yuan at the flagship chain. Moutai, a prominent spirits maker, unveiled cheaper latte and chocolate products infused with its trademark liquor.

Walmart’s Sam’s Club and Alibaba’s Freshippo have engaged in a price war, cutting prices on popular items, such as durian puff pastries, by up to 34% at Sam’s Club. This fierce competition for cost-conscious consumers is reshaping the retail landscape, leading to a decline in the average selling price across various product categories, including supplements, dairy, skin care, and cosmetics.

Despite policymakers expressing optimism about an inflation uptick, recent data indicates a significant fall in consumer prices, raising concerns about prolonged deflation. While the economy is expected to grow by around 5% this year, consumers are not feeling the impact, with high youth unemployment and some office workers experiencing lower wages.

This trend has given rise to a new breed of discount stores, a relatively new phenomenon in China. Lingshi Henmang, a snack brand, plans to expand from 4,000 to 10,000 stores by 2025, citing strong demand. Bestore, China’s largest snack brand, responded to the trend by slashing prices on 300 products in its biggest reductions ever. Hotmaxx, specializing in selling soon-to-expire products at lower prices, aims to expand to 5,000 outlets in the next three years.

As Chinese consumers increasingly prioritize “value for money,” the nation’s retail landscape undergoes a transformative phase with potential repercussions on the broader economic outlook. The experiment of offering lower-priced alternatives, as seen with Haidilao’s Hailao Huoguo, underscores the industry’s attempts to adapt to evolving consumer preferences. However, the longer-term impact on economic stability remains uncertain in the face of persistent deflationary pressures.

Comments