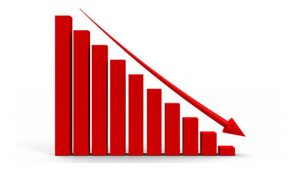

Govt’s expenditure exceeds income

The fiscal deficit is going up as revenue collection is minimal in comparison to public expenditure.

According to the Office of the Comptroller General, the government’s expenditure exceeds Rs 250 billion by May 14 of the current fiscal year 2022/23.

The public expenditure during this period was recorded at Rs 1047 billion while the revenue collection and grant received was equivalent to 797 billion.

The Comptroller General Office stated that the government spending in the last 10 months period is equivalent to 58.41 percent of the annual budget appropriation. The government had brought a budget of Rs 1 trillion 793 billion 837 million 300 thousand for the current fiscal year. Of this budget, the government has so far spent Rs 1047 billion 761 million.

It is said the current expenditure is 66.49 percent, capital expenditure is 33.04 percent and the expenditure towards fiscal management is 58.79 percent until May 14 of the current fiscal year.

The budget under the current expenditure heading for the current fiscal year is Rs 1183. 23 billion and so far 786 billion 740 million has been spent. Similarly, Rs 380 billion 380 million was earmarked under the development heading in the current fiscal year and of this amount, Rs 125 billion 670 million has been spent in the 10 months.

Looking at the status of budget spending during this period, the budget spending under the fiscal management heading exceeds that under the capital heading. Rs 135 billion 3 million 300 thousand has been spend towards fiscal management. The spending under the fiscal management heading is mainly for paying the principal and interest of public debt.

The government has been able to collect only over Rs 756 billion in revenues so far until May 14 against target over Rs 1,403 billion for the current fiscal year, 2022/23. The figure of collect amounts is only 54.66 percent. It remains just two months to complete the current FY.

Similarly, more than Rs 4.8 billion worth of foreign grants has been received, which is only 8.66 percent against target foreign grants worth over Rs 55.4 billion.

So far, over Rs 159 billion has been collected in income taxes against more than Rs 173 billion during the same period in the previous FY.

Also, over Rs 88.06 billion has been raised in taxes so far against more than Rs 90.6 billion during the same period in the previous FY.

As of now, more than Rs 84.1 billion has been collected in excise duties against over Rs 83.8 billion during the same period in the previous FY.

- Qatari Emir’s visit: Govt urged to request for pact on Bhairahawa-Qatar direct flights

- Emir of Qatar at Sheetal Niwas, Meeting with President Paudel Underway

- India Begins Delivery of BrahMos Missiles to Philippines Amid Regional Tensions

- Rabi Lamichhane Assures Repayment of Depositors’ Money, Even via Ordinances

Comments