What Do America’s Spies Really Think About China?

ATLANTA – The US intelligence community’s annual threat assessment for 2023 certainly cannot be faulted for having a narrow focus or Pollyanna perspective. From a rising China, Russian aggression, and Iran’s nuclear ambitions to climate change, future pandemics, and the growing reach of international organized crime, the IC’s analysis is as comprehensive as it is worrying.

Inaugurated two decades ago as a gesture of transparency and to inform Congress and the American public, the annual threat assessment offers the intelligence agencies’ top-line conclusions about the country’s leading national-security threats – though always in ways that will not compromise “sources and methods.” As in the past, America’s spies and intelligence analysts have stayed in their lane and avoided policy questions or any suggestion that some problems are more important than others.

Yet when testifying to the Senate Intelligence Committee on March 8, US National Intelligence Director Avril Haines was not as constrained. She made it abundantly clear that the Biden administration regards China as “our unparalleled challenge,” and as America’s leading national-security threat.

If the annual threat assessment was less categorical, that is because it represents a harmonized view. Differences of expert opinion and bureaucratic battles across 18 intelligence agencies come with the territory, requiring compromises on both wording and substance. Having chaired scores of meetings to coordinate IC assessments as a member of the National Intelligence Council, I can attest to the heated debates that are involved. Forging a consensus among such an animated crowd is a true art.

But as important as it is to argue over evidence and language, it all ultimately takes a backseat to the first step in any analysis: figuring out what questions the final product should address. Part of the answer, of course, depends on the president and other key policymakers. With a $67 billion budget, the IC owes its paymasters that much at least. But the task also calls for a sober examination of the facts and their implications, regardless of whether these align with the administration’s views. Here, this year’s threat assessment fell short.

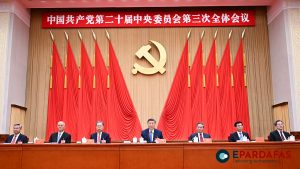

Like the White House, the IC’s assessment emphasizes the threats represented by Chinese President Xi Jinping’s confrontational approach and advances in China’s military, economic, and technological capabilities. But there is less insight into China’s domestic problems and what those could mean for Xi’s regime. As threat assessments go, this omission may be justifiable. But when it comes to improving policymakers’ and ordinary Americans’ understanding of their country’s foremost global competitor, Xi’s domestic difficulties should not get such short shrift.

Consider Xi’s effort to restructure the Chinese property sector following decades of massive investment. According to Michael Pettis of the Carnegie Endowment, this sector accounts for as much as one-third of China’s GDP, but it is extraordinarily bloated and thus underperforming. Two years ago, Chinese authorities tried to crack down on borrowing by overleveraged developers, sparking multibillion-dollar defaults and leaving scores of cities littered with abandoned projects and faced with long construction delays. Many of the big developers are still struggling, as are local governments that have racked up massive debts financing their work.

Even China’s own dodgy official economic statistics reveal a massive festering problem. China’s 31 provinces have racked up $5.1 trillion in debt to fund development, and that figure does not even include all of the additional local government financing vehicles (LGFVs). These off-the-books entities serve as backdoors for municipal governments to tap banks for loans and sell bonds after they have borrowed heavily to finance property and infrastructure projects. According to the International Monetary Fund, the total debt associated with LGFVs has exploded to almost $10 trillion.

This red ink is as much a political problem as a financial one. Chinese LGFVs have $790 billion worth of bonds coming due this year, and another $70 billion of offshore debt will have matured by 2025. Land sales to developers have long been local governments’ principal revenue source. But with these tanking, officials are being forced to slash salaries, pensions, services, and health care in order to service debts.

These cuts have provoked demonstrations in several cities – and it isn’t only workers and pensioners who are upset. China’s burgeoning middle class bet big on real estate in recent years, giving the country a homeownership rate of nearly 90%. But now the property sector’s turmoil is hitting them hard. With 70% of Chinese household wealth tied up in property, owners have seen their nest eggs shrink.

In response, the Chinese government once again eased credit to stimulate the real-estate market last November, and by January, home prices had ended a 16-month decline. But potential buyers remain wary. There is still a massive backlog of unfinished projects, and everyone remembers the large protests last year by would-be homeowners who had taken out up-front mortgages on homes that may never be built. More stalled projects and flagging sales already bode ill for 2023.

To be sure, like other short- and long-term domestic challenges facing China – from growing youth unemployment to a shrinking labor force – property-sector woes are not an immediate threat to Xi’s rule or the Communist Party of China’s power. But they do obviously pose problems for his agenda, both foreign and domestic. Following the massive protests against the zero-COVID policy late last year, Chinese officials are well aware of the political risks. Under Xi, the CPC is expanding its presence in China’s government ministries as well as business boardrooms, and a raft of reforms has tightened access to officials and information.

In short, the IC’s otherwise well-presented unclassified annual assessment should have dug deeper. Congress and the public deserve to hear its best insights into the problems facing Xi’s regime. As we all know by now, what happens in China does not stay in China.

Kent Harrington, a former senior CIA analyst, served as national intelligence officer for East Asia, chief of station in Asia, and the CIA’s director of public affairs.

Copyright: Project Syndicate, 2023.

www.project-syndicate.org

Comments