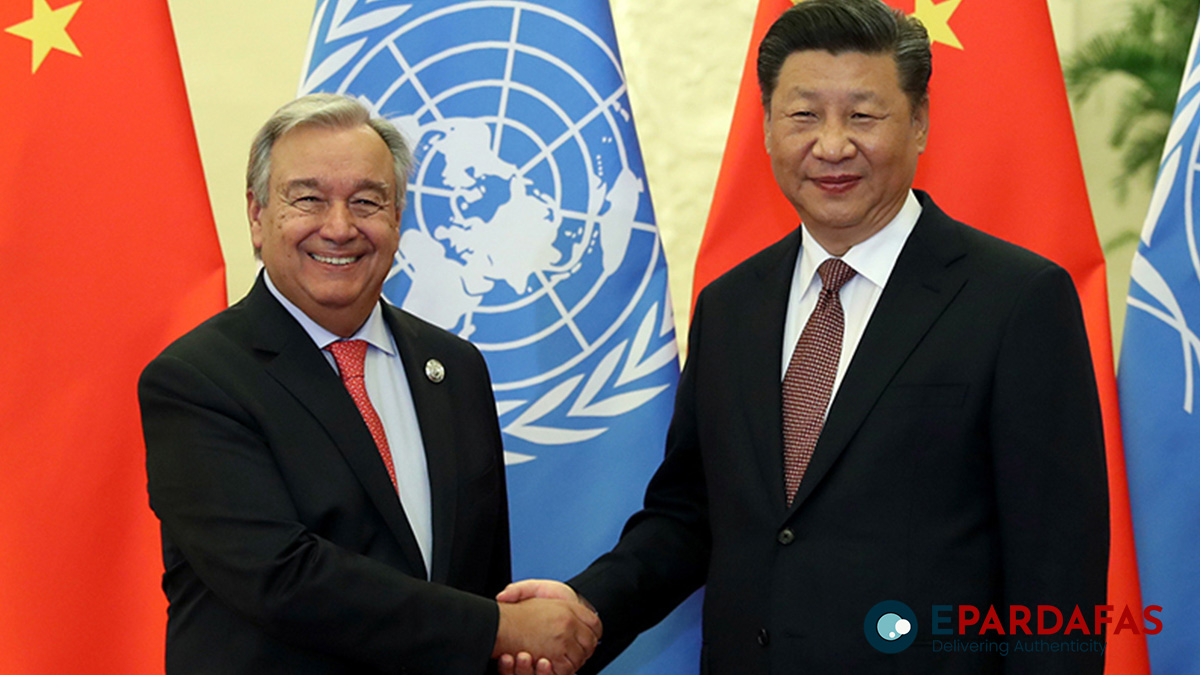

The growing debt crisis in African nations is creating a volatile mix of economic strain, public discontent, and potential for widespread social unrest. United Nations Secretary-General António Guterres has warned that Africa’s current financial state, marked by limited access to debt relief and dwindling resources, is becoming “a recipe for social unrest.” His remarks, made at the China-Africa Cooperation Summit, highlight the need for urgent reforms to the international financial system, which he described as “outdated, ineffective, and unfair.”

A Debt Crisis and Rising Social Unrest

African countries have been grappling with rising debt, compounded by global economic pressures and domestic fiscal challenges. The situation has fueled civil unrest in recent months, most notably in Kenya, where police clashed with demonstrators protesting proposed tax hikes. The unrest spread to Nigeria and Uganda, where citizens have taken to the streets over the rising cost of living. The protests are not isolated incidents but part of a broader wave of frustration as African governments struggle to balance budgets, service debt, and meet the basic needs of their populations.

The debt crisis has exposed flaws in international debt relief mechanisms. The G20’s “Common Framework” initiative, designed to restructure the debt of the world’s poorest countries, has so far failed to deliver swift relief. Zambia, which defaulted on its debt in 2020, only managed to restructure its debt in June 2023—more than three years later—highlighting the framework’s sluggish progress. As more African countries face unsustainable debt, the inadequacy of current solutions becomes increasingly apparent.

Guterres’ Call for Financial Reform

At the Beijing summit, Guterres proposed deep reforms to the international financial architecture, calling for changes that would provide developing nations with better access to liquidity and long-term solutions. His call for reform reflects growing frustration with a system that many argue favors wealthy nations and financial institutions at the expense of developing countries. African nations, often caught between loans from Western creditors, Chinese state-owned banks, and private financial institutions, are struggling to find cohesive solutions that address their immediate financial needs.

Guterres also underscored the importance of concessional funding, which involves providing loans at below-market interest rates, allowing developing countries to meet basic public needs without being crushed by debt repayments. However, African nations are often cut off from such financing due to their perceived financial risks, further exacerbating their crises.

China’s Role in Africa

China, as Africa’s largest bilateral lender, plays a crucial role in the continent’s economic future. At the summit, Chinese President Xi Jinping pledged $50.70 billion in financing over the next three years, signaling Beijing’s commitment to Africa’s development. While China’s financial assistance is welcome, it is not without controversy. Chinese loans are often criticized for their lack of transparency and for leading to debt dependency. However, Guterres praised China’s initiatives, particularly in driving a “renewable energy revolution” and enabling critical transitions in food systems and digital connectivity across Africa.

China’s involvement presents both opportunities and risks. While its financing helps fund critical infrastructure and energy projects, African nations must carefully navigate the terms of these loans to avoid further deepening their debt crises.

Conclusion: The Need for Collective Action

The African debt crisis is a symptom of larger global financial imbalances that require systemic reforms. Guterres’ call for a more equitable international financial system comes at a time when many African nations are at a crossroads—either continue along the current path of unsustainable debt or push for structural changes that can provide long-term stability.

For African countries, the immediate priority is securing debt relief and concessional funding to address the basic needs of their populations. However, for lasting change, reforms to the international financial system are necessary, allowing developing nations to access liquidity without facing crippling debt repayments. Collaboration between African governments, international financial institutions, and key global players like China will be crucial in navigating this complex challenge.

As the continent looks ahead, a balance must be struck between leveraging external financial support and ensuring that such support does not further entrench long-term debt dependence.

Comments