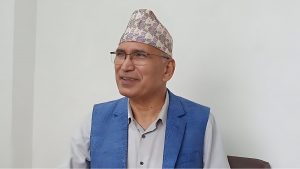

NRB Governor Urges Public to Report Exorbitant Bank Interest Charges, Promises Swift Action

In a bid to ensure fair financial practices, Nepal Rastra Bank (NRB) Governor, Maha Prasad Adhikari, has called upon individuals and entities to report instances of exorbitant interest charges by banks and financial institutions. Speaking on the 27th anniversary of the Society of Economic Journalist Nepal (SEJON), Governor Adhikari emphasized the importance of submitting formal complaints supported by evidence instead of resorting to public unrest.

Governor Adhikari pledged to investigate and rectify any proven cases of banks overcharging interest, revealing that a substantial 4.76 billion rupees were returned in excess interest by banks in the last fiscal year. Dismissing claims of interest rates ranging between 16-18 percent, he noted that more comprehensive data would be awaited in the upcoming first-quarter monetary policy review.

Addressing concerns about the relationship between the finance minister and the governor, Adhikari reassured that the collaboration between NRB and the government remains robust, stating, “NRB is collaborating seamlessly with the government.”

Recognizing the challenges posed by the economic slowdown leading to a rise in non-performing loans, the Governor stressed the necessity to limit dividends. He acknowledged that some business owners were facing difficulties in repayment and highlighted the importance of developing a structured repayment plan after acquiring a loan.

Governor Adhikari underscored the need for a collective approach in tackling economic fluctuations, citing the global prevalence of such challenges. As part of NRB’s commitment to ensuring financial fairness, the Governor’s call for public involvement aims to strengthen the regulatory framework and foster a transparent financial system in Nepal.

Comments