Europe Charts New Course: India-Middle East-Europe Economic Corridor (IMEC) as Alternative to BRI

Italy has made a bold move by deciding to withdraw from China’s Belt and Road Initiative (BRI), marking a significant development in international relations. As the only G7 nation to participate in the BRI, Italy’s decision is perceived as a snub to China. Reports suggest that Italy has formally submitted its withdrawal plan, citing dissatisfaction with the outcomes of the BRI. Trade imbalances and disappointment over unmet promises have played a role in Italy’s departure. The timing of the withdrawal announcement, just ahead of the EU-China summit, adds a layer of complexity and potential strain to diplomatic relations.

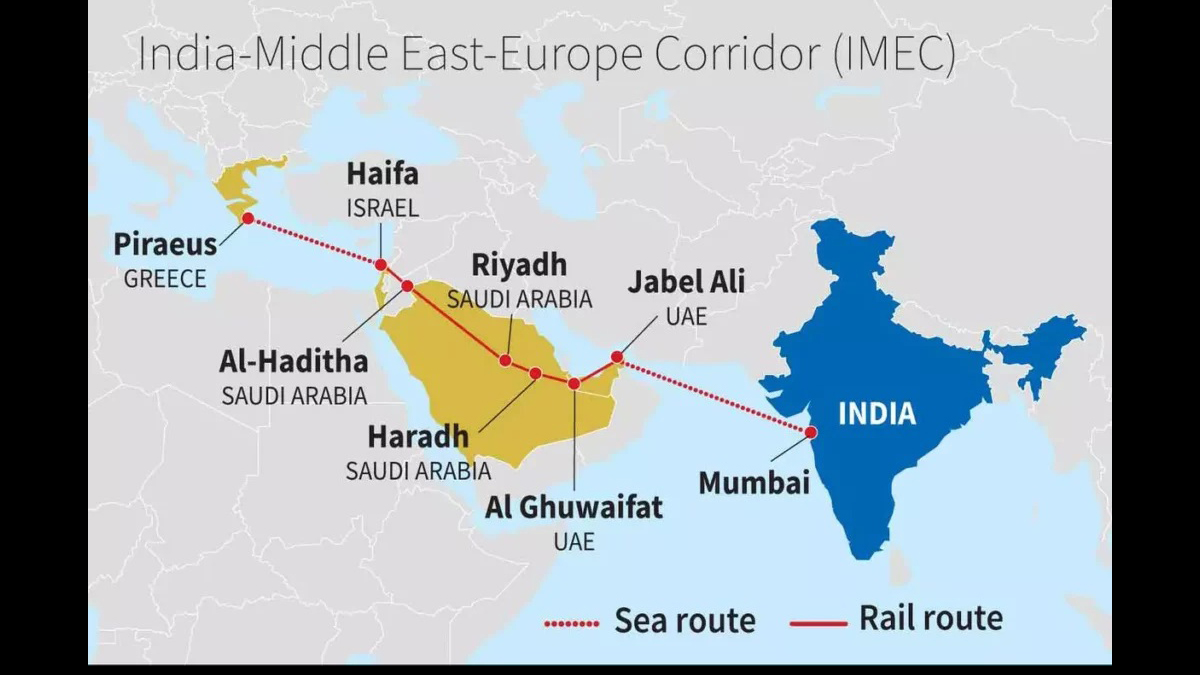

Emergence of IMEC as Europe’s Answer

In response to Italy’s withdrawal and broader concerns about the BRI, Europe is actively exploring alternative infrastructure initiatives. The India-Middle East-Europe Economic Corridor (IMEC) emerges as a key contender, garnering support from the European Union, India, and other stakeholders. IMEC aims to promote sustainable infrastructure investments and establish a reliable cross-border transit network. The move reflects growing concerns about China’s extensive involvement in European ports, raising questions about security risks associated with such partnerships.

Security Concerns along Karakoram Highway

Recent security challenges along the Karakoram Highway, a critical component of the China-Pakistan Economic Corridor (CPEC) within the BRI, have come to the forefront. An attack on a passenger bus near the highway has heightened concerns about the safety of this vital route connecting China to the Gwadar port in Balochistan. Ongoing militant activity and sectarian tensions in the Gilgit-Baltistan region pose tangible threats to Chinese interests and the overall success of the CPEC project.

China’s Belt and Road Initiative Debt Challenges

A comprehensive report by AidData sheds light on the debt challenges associated with China’s Belt and Road Initiative. More than half of China’s $1.1 trillion loans to low- and middle-income countries have entered their principal repayment periods. The report indicates that 55% of the outstanding debt has entered principal repayment, with projections suggesting this could rise to 75% by 2030. Concerns about debt traps and environmental, social, and governance risks in China-financed projects are underscored. China is adapting its strategy, emphasizing “small yet smart” projects and opting to outsource risk management to foreign institutions.

China’s Diplomatic Challenges and Adaptations

China is grappling with diplomatic challenges as public approval ratings decline in lesser developed countries, accompanied by less favorable media coverage. Despite these challenges, China has effectively maintained support from governing elites, as evidenced by voting patterns in the U.N. General Assembly. Described as becoming an “increasingly adept international crisis manager,” China is outsourcing risk management to foreign institutions. This strategic shift reflects an effort to navigate an evolving international landscape and address concerns related to the BRI’s economic and geopolitical implications.

Comments